Stay tuned for the latest FinTech news with goblog

Subscribe to goblog and get useful articles about

FinTech innovations and managing your finances.

FinTech innovations and managing your finances.

Your data is always safe with us. By clicking the button you agree our

Join the waitlist

Be the first to get all benefits of a new fair credit score

Your data is always safe with us. By clicking the button you agree our

Meld på ventelisten

Vær den første som får alle fordelene ved en ny rettferdig kreditt score

Your data is always safe with us. By clicking the button you agree our

9 reasons to check your credit score regularly

5 min read

12.09.2019

Tips&Tricks

by Max

This practical article helps you understand:

- why you should keep an eye on your credit score and report;

- positive consequences of credit score checking;

- 9 important reasons to check your credit data;

- where you can check your credit score and report.

- why you should keep an eye on your credit score and report;

- positive consequences of credit score checking;

- 9 important reasons to check your credit data;

- where you can check your credit score and report.

Most people very rarely initiate a credit score check themselves. And they only think about their credit score when they apply for a loan or were denied a loan.

What does a credit score mean?

A credit score is a number that shows your ability to repay future loans. Your credit score is calculated based on your credit history and information from your credit report.

Even if you don't plan to take a loan now, you create your credit history every day.

That's why we believe that it's very important to monitor your credit score.

Therefore, we have prepared this useful article with 9 reasons why you should check your credit score regularly.

Even if you don't plan to take a loan now, you create your credit history every day.

That's why we believe that it's very important to monitor your credit score.

Therefore, we have prepared this useful article with 9 reasons why you should check your credit score regularly.

9 reasons to check your credit score regularly

1. Сheck current credit situation

Any changes need to start with an analysis of your current situation. Perhaps you are just a step away from moving to a more advantageous category of credit score. Or maybe the existing credit score surprised you and turned out to be much lower than you expected.

Only by knowing your current credit score will you be able to develop the right financial behavior strategy.

Only by knowing your current credit score will you be able to develop the right financial behavior strategy.

2. Be sure that all information is correct

Check information in your credit report to be sure that all data is correct. Incorrect information can lower your credit score and the chance to get a profitable loan with low interest rates.

For example, check your credit report for typos in your personal data. A mistake of just 1 letter or number may result in the loss of part of your credit history.

For example, check your credit report for typos in your personal data. A mistake of just 1 letter or number may result in the loss of part of your credit history.

3. Correct outdated information in the credit report

Credit reference agencies (CRA) don't use all of your credit and personal information to prepare a credit report and calculate a credit score.

For example:

For example:

any information about loans received and repaid earlier than 10 years isn't taken into account when calculating a credit score;

information about debt collection can not be stored for more than 4 years. After that it's no longer used in the calculation of a credit score

any information about loans received and repaid earlier than 10 years isn't taken into account when calculating a credit score;

information about debt collection can not be stored for more than 4 years. After that it's no longer used in the calculation of a credit score

any information about loans received and repaid earlier than 10 years isn't taken into account when calculating a credit score;

information about debt collection can not be stored for more than 4 years. After that it's no longer used in the calculation of a credit score

Therefore, be sure that your credit report doesn't contain outdated information.

4. Fix mistakes in your credit report

Sometimes you may find in your credit report information with mistakes or illegal (for calculating credit score) data about you.

For example:

For example:

if an investigation is opened against you by a debt collection agency, then this information is taken into account by CRAs only 30 days after the case is opened;

information on disputed claims should not be taken into account when calculating your credit score.

if an investigation is opened against you by a debt collection agency, then this information is taken into account by CRAs only 30 days after the case is opened;

information on disputed claims should not be taken into account when calculating your credit score.

if an investigation is opened against you by a debt collection agency, then this information is taken into account by CRAs only 30 days after the case is opened;

information on disputed claims should not be taken into account when calculating your credit score.

You can find the full list of data allowed for calculating a credit score on the official website - Datatilsynet.

That's why it's very important to check your credit report to be sure that it doesn't contain mistakes or illegal types of information.

That's why it's very important to check your credit report to be sure that it doesn't contain mistakes or illegal types of information.

You can read more about credit report in our article "What will you find in your credit report".

5. Protect your credit report from fraud

By checking your credit score regularly, you can notice new and unfamiliar activity. If fraudsters stole personal or credit information from you, a quick response is very important.

If your credit score drops unexpectedly, check your credit report for new loans that you didn't get.

As soon as you discover unknown (new) loans in your credit history, immediately contact the CRA to place a Fraud Alert on your credit report.

If your credit score drops unexpectedly, check your credit report for new loans that you didn't get.

As soon as you discover unknown (new) loans in your credit history, immediately contact the CRA to place a Fraud Alert on your credit report.

6. Get loans with better interest rates

If you monitor your credit score regularly, you can find steps to increase your credit score. With a high credit score, you can apply for the most favorable conditions and the lowest interest rates on mortgages, consumer loans, and credit cards.

So if you plan to make a major purchase by credit, check your credit score in advance. Perhaps you are one step away from a better credit score.

So if you plan to make a major purchase by credit, check your credit score in advance. Perhaps you are one step away from a better credit score.

7. Find out why you have been rejected for a loan

Every time you want to get a loan or lease a car, banks and other companies request your credit report with information about your credit history. Based on your credit score and report, banks decide to grant you a loan or refuse.

Unfortunately, banks and most CRAs don't explain the reasons for refusing credit.

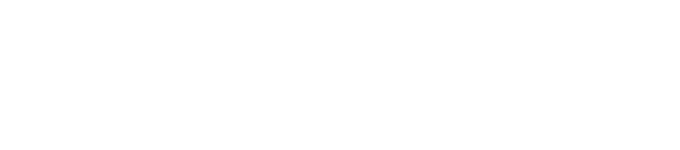

With goscore you will be able to check your credit report and score and get an explanation of what factors affect your credit score the most. In app (and on our blog) you may find tips and advice on how to increase your credit score and get a loan with low interest rates.

For this reason alone, you should regularly check your credit score.

Unfortunately, banks and most CRAs don't explain the reasons for refusing credit.

With goscore you will be able to check your credit report and score and get an explanation of what factors affect your credit score the most. In app (and on our blog) you may find tips and advice on how to increase your credit score and get a loan with low interest rates.

For this reason alone, you should regularly check your credit score.

8. Control credit information if you are a co-signer of a friends' loan

If you are a co-signer of a loan for a family member or close friend, you should check your credit score regularly to make sure that your friend regularly pays the loan and your credit score is not reduced.

If you suddenly find that there is a delay in payments on a loan, you can quickly react and prevent serious harm to your credit history.

If you suddenly find that there is a delay in payments on a loan, you can quickly react and prevent serious harm to your credit history.

9. Get advice and tips to increase your credit score

When you use the goscore app, you not only see your credit score and report but also get useful advice and tips on how to improve your credit history and increase your credit score. You get these tips for free.

You can read more about credit score in our article "What does a credit score mean?"

Where can you check your credit score?

There are currently 4 companies (credit reference agencies) in Norway that can calculate your credit score: Creditsafe, EVRY, Experian and Bisnode.

goscore is now working on developing its own system of credit scoring, and once we become a licensed Credit Reference Agency (CRA) we will be among these companies. And you will get your credit report and credit score for free.

goscore is now working on developing its own system of credit scoring, and once we become a licensed Credit Reference Agency (CRA) we will be among these companies. And you will get your credit report and credit score for free.

Official sources

We have prepared a list of official sources from which you can learn more about credit scoring.

Datatilsynet - read about credit scoring.

Datatilsynet - current credit score regulations.

Datatilsynet - read about credit scoring.

Datatilsynet - current credit score regulations.

Summary

It's important to check your credit score to increase your chances of getting a new loan with low interest rates.

1

Check your credit report regularly to make sure it has correct data without outdated information, mistakes and typos.

2

Checking a credit score allows you to know your current credit situation and understand why a loan application was rejected.

3

Protect your credit history from fraud by checking your credit report regularly.

4

CEO @ Goscore

Maksim Hardziyenak

Education

Max has a bachelors degree in programming and mathematical methods and models. That's why he is not only an excellent developer but also an experienced Data Science and Machine Learning specialist.

Max holds an MSc degree in logistics and is currently working to obtain an MBA degree.

Job and experience

Max developed and taught his own IT course at the BSU (Belarus).

He has previously worked as a Senior Developer, Product Manager, CTO, and independent IT consultant.

Now Max applies all his accumulated experiences in the creation and development of Goscore.

What colleagues appreciate in Max

Colleagues appreciate Max's support, advice, and ability to analyze the situation from all sides and offer the best solution.

Hobby

His secret hobby is assembling realistic car models.

Max has a bachelors degree in programming and mathematical methods and models. That's why he is not only an excellent developer but also an experienced Data Science and Machine Learning specialist.

Max holds an MSc degree in logistics and is currently working to obtain an MBA degree.

Job and experience

Max developed and taught his own IT course at the BSU (Belarus).

He has previously worked as a Senior Developer, Product Manager, CTO, and independent IT consultant.

Now Max applies all his accumulated experiences in the creation and development of Goscore.

What colleagues appreciate in Max

Colleagues appreciate Max's support, advice, and ability to analyze the situation from all sides and offer the best solution.

Hobby

His secret hobby is assembling realistic car models.

Stay tuned for the latest fintech news with goblog

Subscribe to goblog and get useful articles about

fintech innovations and managing your finances.

fintech innovations and managing your finances.

Read more useful articles

6 min read

Academy

6 min read

Academy

6 min read

Tips&Tricks