Stay tuned for the latest FinTech news with goblog

Subscribe to goblog and get useful articles about

FinTech innovations and managing your finances.

FinTech innovations and managing your finances.

Your data is always safe with us. By clicking the button you agree our

Join the waitlist

Be the first to get all benefits of a new fair credit score

Your data is always safe with us. By clicking the button you agree our

Meld på ventelisten

Vær den første som får alle fordelene ved en ny rettferdig kreditt score

Your data is always safe with us. By clicking the button you agree our

What will you find in your credit report?

6 min read

15.08.2019

Academy

by Max

This practical article helps you understand:

- what a credit report is and what it shows;

- how you can get your credit report;

- how you can change the information in a credit report;

- what you need to do if you have no credit history;

- connection between your credit score and report.

- what a credit report is and what it shows;

- how you can get your credit report;

- how you can change the information in a credit report;

- what you need to do if you have no credit history;

- connection between your credit score and report.

What is a credit report?

Your credit report is a document (file) that contains information about your payment and credit history. It shows how you managed finances and credit funds in the past and predicts your financial behavior in the future.

Credit reference agencies (CRA) prepare your credit report on behalf of the banks or other companies when you apply for a new credit card, car loan or credit for purchasing any household appliances.

Credit reference agencies (CRA) prepare your credit report on behalf of the banks or other companies when you apply for a new credit card, car loan or credit for purchasing any household appliances.

What type of data does a credit report contain?

Your credit report contains information that describes your ability to manage your finances. This information is divided into 3 different categories (or parts), as seen below:

- name and last name;

- current address;

- phone number (publicly available);

- other information (e.g., email for getting credit report by mail).

- ownership of real and personal property or motor vehicles;

- bankruptcy or insolvency;

- the processes opened by collection agencies against you;

- if a person is under guardianship;

- taxes;

- pledge of real estate and personal property.

- payment defaults;

- currently open credit lines;

- closed/refinanced credits;

- registered debt settlement.

Data from different publicly available sources:

Information about credit and payment history:

Personal and contact information

Part 1 "Personal and contact information" is for informational purposes only. It means that the data from this part cannot be used in calculating your credit score.

Data from Part 2 "Data from different publicly available sources" and Part 3 "Information about credit and payment history" is used to calculate your credit score.

Data from Part 2 "Data from different publicly available sources" and Part 3 "Information about credit and payment history" is used to calculate your credit score.

What type of information cannot be used in calculating a credit score?

To avoid social or religious discrimination, part of the information about you cannot be collected in the credit report and thus cannot be used in calculating a credit score:

If you want, you can prohibit the provision of credit reports and score to third parties. In this case, only you will have access to the credit report and companies will receive a message that you have closed access to your credit report.

- the addresses where you lived before;

- your gender, religion;

- disputed claims (not considered until there is a final judgment on the case);

- earlier requests for a credit report;

- sensitive personal data.

If you want, you can prohibit the provision of credit reports and score to third parties. In this case, only you will have access to the credit report and companies will receive a message that you have closed access to your credit report.

Information sources for a credit report

When CRAs prepare your credit report, they can obtain information from different sources:

Population register

Debt collection agencies

Public address distributors

Central register of motor vehicles

Registers «Brønnøysundregistrene»

Norwegian media (Norsk lysingsblad)

Statistic Agency (SSB)

Norwegian Tax Administration

Courts

How can you get your credit report?

There are currently 4 CRAs in Norway that can calculate your credit score: Creditsafe, EVRY, Experian and Bisnode.

Goscore also develops own system of credit scoring and after getting a license of credit reference agency soon will be among these companies.

You can get your credit report when:

Goscore also develops own system of credit scoring and after getting a license of credit reference agency soon will be among these companies.

You can get your credit report when:

you apply for a new loan or credit card. In this case you get a copy of the credit report which the bank or company got from the CRA;

you request it from a CRA to know your credit score.

you apply for a new loan or credit card. In this case you get a copy of the credit report which the bank or company got from the CRA;

you request it from a CRA to know your credit score.

you apply for a new loan or credit card. In this case you get a copy of the credit report which the bank or company got from the CRA;

you request it from a CRA to know your credit score.

Find out more in our 9 reasons to check your credit score.

Why do you need to check the information in your credit report?

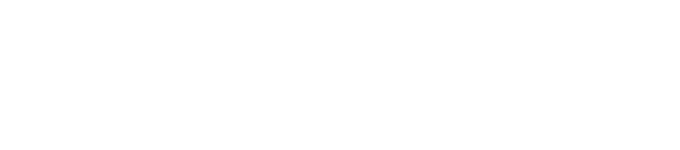

Based on the data from your credit report, your credit score is calculated. And after receiving your credit report and score, companies and banks decide whether or not to give you a loan and on what terms.

The closer your credit score is to a high scale level, the higher the likelihood of obtaining a profitable loan. And the lower your credit score, the more careful banks will be in deciding to give you a loan.

The closer your credit score is to a high scale level, the higher the likelihood of obtaining a profitable loan. And the lower your credit score, the more careful banks will be in deciding to give you a loan.

That's why we always advise you to first check your credit report and score, improve it (if it's low) and then apply for a loan.

How can you change the information in your credit report?

If you find a mistake in your credit report, you can contact a CRA to open a dispute and fix it. For example, mistakes in the name may result in your credit report not showing your long good credit history, which will lower your credit score.

CRAs must investigate your dispute about incorrect data in your credit report and after the investigation, the information must be deleted or corrected.

If information is correct, you can't change it. But you can add some notice to explain your financial behavior or clarify your late payment.

CRAs must investigate your dispute about incorrect data in your credit report and after the investigation, the information must be deleted or corrected.

If information is correct, you can't change it. But you can add some notice to explain your financial behavior or clarify your late payment.

What do you need to do if you have no credit history?

The credit report shows how you managed previous loans and whether you made payments on time or not.

Therefore, if you have no prior loans or credit cards, your credit report may be almost empty and your credit score may be lower than you expected. This can in turn affect your chances of getting a loan with low interest rates.

But you can change this situation.

Start to build your good credit history step by step and you will a get good credit score soon. For example, you can apply to get a credit card and make payments on time every month to show that you are a financially responsible person.

Therefore, if you have no prior loans or credit cards, your credit report may be almost empty and your credit score may be lower than you expected. This can in turn affect your chances of getting a loan with low interest rates.

But you can change this situation.

Start to build your good credit history step by step and you will a get good credit score soon. For example, you can apply to get a credit card and make payments on time every month to show that you are a financially responsible person.

Find out more about credit history in our 8 tips: what to do if you have no a credit history.

What came first: credit report or credit score?

Your credit report is based on information about you and your payment and credit history.

Your credit score is based on data from your credit report. And it may vary depending on how each CRA calculate this score.

Your credit score is based on data from your credit report. And it may vary depending on how each CRA calculate this score.

How we explain «credit report» to children

Your record card at school is like your parents' credit report. The record card at school shows your study activities and progress. And the credit report shows payment activity and ability to manage finance well.

If you want to study at the best university, you need to get a «6» or «A» on your school record card. And to get it, you have to do your homework on time and get high marks for the control and examination tests.

If your parents want to get a profitable loan, they need to have a good credit report and a high credit score. And to get it, they have to manage their money wisely and build a good credit history.

If your parents want to get a profitable loan, they need to have a good credit report and a high credit score. And to get it, they have to manage their money wisely and build a good credit history.

If you want to study at the best university, you need to get a «6» or «A» on your school record card. And to get it, you have to do your homework on time and get high marks for the control and examination tests.

If your parents want to get profitable credit, they need to have a good credit report and a high credit score. And to get it, they have to manage their money wisely and build a good credit history.

If your parents want to get profitable credit, they need to have a good credit report and a high credit score. And to get it, they have to manage their money wisely and build a good credit history.

Your record card at school is like your parents' credit report. Record card at school shows your studying activity and progress. And the credit report shows payments activity and ability to manage finance well.

Your record card at school is like your parents' credit report. Record card at school shows your studying activity and progress. And the credit report shows payments activity and ability to manage finance well.

If you want to study at the best university, you need to get a «6» or «A» on your school record card. And to get it, you have to do your homework on time and get high marks for the control and examination tests.

If your parents want to get profitable credit, they need to have a good credit report and a high credit score. And to get it, they have to manage their money wisely and build a good credit history.

If your parents want to get profitable credit, they need to have a good credit report and a high credit score. And to get it, they have to manage their money wisely and build a good credit history.

Official sources

We have prepared a list of official sources from which you can learn more about a credit score.

Datatilsynet - read about credit scoring and CRA.

Datatilsynet - current credit score regulations.

Datatilsynet - read about sensitive personal data.

Datatilsynet - find contact information of CRA if you want to close access to your data.

Datatilsynet - read about credit scoring and CRA.

Datatilsynet - current credit score regulations.

Datatilsynet - read about sensitive personal data.

Datatilsynet - find contact information of CRA if you want to close access to your data.

Summary

Your credit report is a document (file) that contains information about your payment and credit history. It shows how you managed finances and credit funds in the past and predicts your financial behavior in the future.

1

A credit report contains 3 types of information: contact information, publicly available records from different official sources and information about payment and credit history.

2

You can request your credit score from a CRA or get it automatically when you apply for a new loan.

3

If you find a mistake in your credit report, you can contact a CRA to open a dispute and fix it. Also, you can add some notice to explain your financial behavior or clarify your late payment.

4

If you have no credit history, start to build your good credit history step by step and you will get a good credit score soon.

5

CEO @ Goscore

Maksim Hardziyenak

Education

Max has a bachelors degree in programming and mathematical methods and models. That's why he is not only an excellent developer but also an experienced Data Science and Machine Learning specialist.

Max holds an MSc degree in logistics and is currently working to obtain an MBA degree.

Job and experience

Max developed and taught his own IT course at the BSU (Belarus).

He has previously worked as a Senior Developer, Product Manager, CTO, and independent IT consultant.

Now Max applies all his accumulated experiences in the creation and development of Goscore.

What colleagues appreciate in Max

Colleagues appreciate Max's support, advice, and ability to analyze the situation from all sides and offer the best solution.

Hobby

His secret hobby is assembling realistic car models.

Max has a bachelors degree in programming and mathematical methods and models. That's why he is not only an excellent developer but also an experienced Data Science and Machine Learning specialist.

Max holds an MSc degree in logistics and is currently working to obtain an MBA degree.

Job and experience

Max developed and taught his own IT course at the BSU (Belarus).

He has previously worked as a Senior Developer, Product Manager, CTO, and independent IT consultant.

Now Max applies all his accumulated experiences in the creation and development of Goscore.

What colleagues appreciate in Max

Colleagues appreciate Max's support, advice, and ability to analyze the situation from all sides and offer the best solution.

Hobby

His secret hobby is assembling realistic car models.

Stay tuned for the latest fintech news with goblog

Subscribe to goblog and get useful articles about

fintech innovations and managing your finances.

fintech innovations and managing your finances.

Read more useful articles

6 min read

Academy

5 min read

Tips&Tricks

6 min read

Tips&Tricks